If you are looking ahead to setting up your own Family Office or becoming an IFA from being a wealth manager then this is the best phase of your time. The rules of the game have changed and the speed of change is much faster than ever it has been for the distribution Industry in the last 30 years. The financial planning, advisory, and client management ecosystem will take a quantum jump in the coming 2 to 3 years when the well-experienced wealth managers from distribution outfits come up to start their own businesses.

3 years before in 2019, we came up that Distribution Industry 3.0 depicted the transformation of the industry where distributors need to become Manufacturers. We find NJ coming up into AMC and Groww taking over Indiabulls AMC. In the next 2 years down the line, we will find a significant changeover in the wealth vertical where Ex bankers and wealth managers in distribution houses will be coming up aggressively to start their own businesses. This is nothing new but we will find a quantum jump in terms of these family offices starting up and growing a significant AUM base.

In every wealth, vertical PMS and AIF have started playing a very pivotal role in the survival of the employees. This is well reflected in terms of the AIF industry where the AUM jumped from Rs. 3lakhs cr in 2019 to Rs.7 lakh cr as of today. This is no doubt an upfront revenue business model which makes quantum earning and survival way for the cutthroat competition prevailing in the distribution Industry. PMS and AIF are going to be in high demand as the Indian economy and markets are going to reach new highs. Further new structured products will be coming up in the next few years which will also drive significant revenue and growth for the distribution Industry. Hence it is wise to start your own rather than working for someone to fight for justification of 5 times revenues. For example, the unlisted share is a significant area where distribution wealth managers turned into family offices and IFA are earning huge compared to what they used to get as salary.

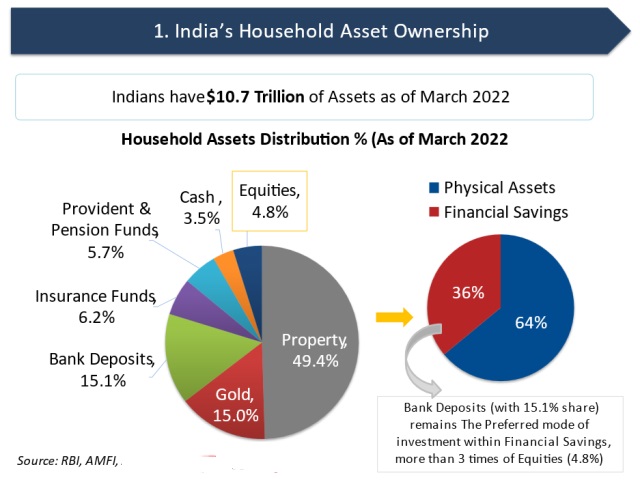

In the last few years, we have seen that physical assets are declining and financial assets are increasing and this trend will continue for the next 10 years as of now. Hence there is a wide opportunity for newcomers.

On the other hand, clients are also looking ahead for niche products away from traditional products like Mutual Fund and direct equities. The structured products segment has taken a quantum jump due to changes in taste and preferences among the clients. PMS has taken a sharp jump since investors don’t have much time compared to covid times and their portfolios have increased by many folds making PMS one of the best products.

A wealth manager who deals directly with clients is in the best sweet spot today. After working for 10 years and accumulating a good set of clients building up an AUM of Rs 10 cr or more in the next 2 years is now quite easier compared to slogging one's ass in the distribution platform. You might be called it entrepreneurship or family office or IFA but in the end, it's freedom from this immense pressure of distribution. The stockbroking business has lost its glory due to discount broking. Now it is just baiting to catch new clients. Today the client does not only do diversification in investment asset class but also in terms of the distributors and avenues through which they do investment. We have found that in many cases wealth managers are scared that if partial or full profit booking is done by the client the client will open up new doors for doing fresh investments rather than getting back to the ones with whom he started.

The Distribution industry will witness new breeds of quality wealth managers starting as IFA and later coming up with their own PMS and AIF products backed by PE and VC. The dynamics of the game have changed today. Platform service providers are struggling today since so many 1000 platform service providers have come up reducing the margins and glory enjoyed 5 years before. This has led to a significant reduction in the setup cost of the family office or becoming an IFA.

Most of the wealthy outfits are now struggling with manpower and with the Indian economy and markets being in a strong position over the next 10 years it has become a very wise decision to start and build their own AUM and own distribution setup. If anyone is looking ahead to expanding at the National level PE and VC make it much easier. We all know that bank wealth managers are under the highest grade of pressure and this is the place where most of the next generation IFAs are coming up.

The power of pricing and control has moved away from the Asset Management to the Distributors in the last 10 years now the same is moving output from the hand of Distribution to the wealth managers who are coming up and building 10 cr or 100 cr AUM over the next 3 years. The speed of building AUM has become much faster driven by social media and knows tricks and strategies by the wealth managers.

The reason behind such aggressive family offices opening up is intense pressure in the distribution Industry 5 times justification asked by the company. In many cases, a misselling attitude takes birth and in many cases, wrong products are sold where margins are high in order to save from losing the justification game. The maturity of the market has changed dramatically; now NRI client segment is aggressively looking ahead to doing investments in India and hence starting its own business is now the best option. Building a client base over the 10 years and then starting your win is the best match-winning formula. Further, it is not compulsory that you need to work for 10 years to start your own even joining hands with others will expedite your opportunities. The earnings are also quite high since having a book size of 10cr or 100cr leads to significantly higher income compared to the salary you earned every month.

The power of the distribution Industry is shifting and in the coming years, we will find significant M&A which is nothing but consolidation in times of revenue war.

0 Comments:

Post a Comment