INWARD FDI OF CHINA

China economy has always been in to tough policy decisions and decisions which will bring growth for other economies too. In fact china follows the rule of prosperity where I will not grow along but I will grow along the society. In its latest FDI policy China has opened up new gates where flow of investments will come.

China has added sectors which include high-end manufacturing like textiles and machinery, emerging industries that bring new technologies to China, as well as green businesses like battery recycling. Services industries such as auto charging stations, intellectual property rights service and career training will also be welcome. The below image depicts the GDP growth and the FDI growth of China from 2001 to 2006.I provided this old data since to make an clear understanding of the World Economic Boom Period.

This time their has been a turnaround in the policy framework designed by china. China has included rather removed protection cap from many sectors which were earlier were not allowed for FDI investments.

This removing of cap clearly depicts the change in cultural outlook being envisaged by china towards its economic growth. Overseas investment in medical institutions and financial leasing firms has been including in the new FDI policy of China. At the same time china has capped FDI investments in automobile, poly silicon and coal chemical plants due to its over capacity of production. Under the new policy FDI investments has been encouraged in the circular economy, the collection and treatment of waste electronic appliances and electronic products, mechanical and electrical equipment, and batteries.

Further the policy states attraction of FDI in energy-saving and environmental protection, new-generation information technology, biology, high-end equipment manufacturing, new energy, new materials, and new energy vehicles. The new FDI Catalog includes key component parts for new energy vehicles and next-generation internet system equipment based on IPv6, Along these lines, nine service industries have been added to the encouraged category in the new Catalog, including motor vehicle charging stations, venture capital enterprises, intellectual property rights services, marine oil pollution clean-up technical services, vocational skills training, Hence the new FDI policy is an compact and well designed to attract investments which will rule the world in coming decades.

The guidelines of the new FDI policy will come into effect on January 30, 2012. Further foreign capital in the energy sector involving exploration and development of unconventional sources such as shale gas and deep-sea gas hydrates have been deeply focused under the new guideline of FDI. At the same time foreign investors will possibly be encouraged to form joint ventures or to cooperate with Chinese companies to enter into these sectors.

In the side chart we find the historically china FDI utilization efficiency has only grown.

This new policy will also have the same affects as in the history it has created on the developed economies. This new policy in turn has led to continued loss of manufacturing industries and jobs, further weakening the vitality of these economies. From the pages of history we find many instances about the number of increasing unemployment across the globe due to China’s FDI policies. The extremely low Chinese labor costs lures multinationals to do investments away from other Asian and Latin American to low-cost export platforms created by China. FDI flows from the US dropped by 23.05 per cent year-on-year to USD 2.74 billion in November.

China is holding the No.1 position for nine consecutive years. A rising middle class followed with growing incomes, urban migration & increasing market demand are considered to be the main factors which enables China to attract FDI. Despite of the global economic turmoil, inflows into the Chinese economy came at US$175 billion in 2010, up 1% from last year, which was US$7 billion higher than its foreign investment peak in 2008. FDI in China’s services sector showed the fastest growth from January to May this year, increasing 31.3% compared to the same period in 2010.

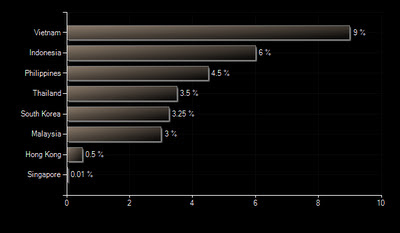

There is a growing number of studies on the potential Chinese FDI diversion. In a series of papers, Chantasasawat, Fung, Iizaka and Siu (2003, 2004a, 2004b and 2004c), Eichengreen and Tong (2005) and Zhou and Lall (2005) provided econometric evidence concerning the impact of the rise of China on the FDI inflows to East.

China has again lead such an policy where other economies across the world will have to become more competitive to attract FDI. In fact India is the first one to whom the challenge has been thrown and it’s up to the famous political heads of India that how they will deal with the challenge. Currently India surged to the second place, passing the United States. India’s previous FDI peak was achieved in 2008, when it attracted US$43 billion, while last year the number dropped to US$25 billion. Hence the challenge for Indian FDI is now the biggest game. And in order to attract the FDI in India we need policies like Companies Bill, Land Acquisition Bill and DTC are the few which will help India to attract FDI. Special focus needs to be provided to SEZ which is currently reeling under pressure.SEZ is the one of the prime weapons which will help India to attract FDI.

Well China is poised for another round of growth where as developed economies will find some space for growth but the transfer of human capital is biggest requirement of the time.