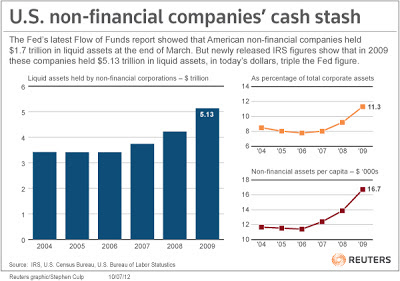

Balanced score card effect is only being restricted or being applied only to the financial perspective of the organization. Even in the western world from where the Balance score card came into affect into the management books was also remained constrained within the cubicle of financial perspective. The biggest poof of the same is the collapse of world’s best organizations like Lehman Brothers, Bank of Merrill lynch and many thousands of companies, the name of them remained unheard to the eras of the world economy.

In my previous article Combination of Costing Strategies and Methods I placed the concept of application of various costing tools to create and combination of cost strategies which will drive the coming decades. In this article I am again depicting another model where cost strategies can become more powerful while designing the budgets of an organization. We all know that budget is the mother of cost related to any part of the organization.

I find in my research that traditional budget making processes are of no effective use for an organization. Budgets traditional are based upon previous year’s numbers followed with additions from the auditor’s reports about deviations. In my research I find that adoption of various tools into the process of budget making can be of stupendous result for an organization. The four pillars of Balance Score card can be of magical performance improvement for an organization when its being mixed up within budget making process.

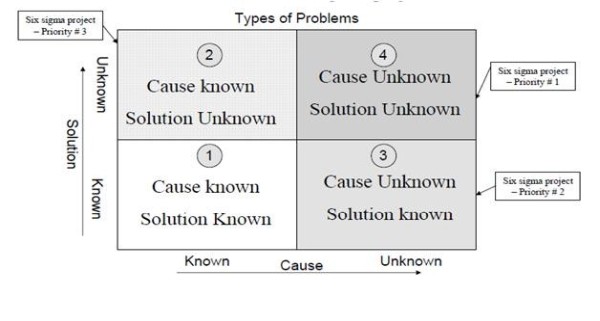

A question often hunts that when and where the balance score card needs to implement. I find while preparing the budget one should keep balance score card within the process so that proper identification of resource allocation as well as the future business targets can be kept rightly aligned. While preparing the budgets one will get a clear idea about the previous scorings of the balance score card and the areas which needs right allocation for achieving the target of the balance score card of the organization. Budget making process needs to have new dimension so that balanced score card takes full shape within the organization principles and policies. While making budgets I found that cost cutting is prime focus followed with efficient use of resources. I find the efficient use of resources is a concept being adopted with a wrong meaning. Efficient use of resources allocation of right cost with right cost centre. It’s the opposite of cost cutting in simple terms.

Financial perspective is the prime area of focus of financial score keepers. With changing process and times budgets process needs to be changed. Financial accounting models never accounts for learning and growth perspective. The process of achieving the financial perspective is never taken into account aligning with the long term sustainability of the organization. Analyst and financial score keepers are brilliant in calculating the short term perspective of an organization. The collapse of the big giants is the proof of the pudding which was practiced over the last decade.

We often hear that pink slips are being still offered by companies across the globe. Well we are only being told that organizations are facing the heat of recession and that’s why mass layoff is being executed. I find balanced score card was never thought within the organization and short term financial perspective was practiced at the optimum level which created the high unemployment. Well don’t think that Balanced score card is a concept only adopted in the Fortune 500 companies. It’s being hardly being adopted anywhere otherwise picture would have been different.

Learning and Growth perspective of the balanced score card is the back bone of the entire Balanced Score card. If employees of an organization are not being factored within the development process of any part of an organization then how the score keepers will come up with the financial perspective. Profit gimmick is the killing instinct of an organization at all times and every time.

Short term profitability often ignores employee’s growth and learning process. Skilled manpower has been the key factor behind the growth of every economy every industry across all times. Historically and at present we find many evidence of this. Today US economy has managed to archive a technological boost up in oil exploration from deep within the ocean through excellent human capital or employees. New strategies for growth and innovation of products can be only be achieved when adoption of learning and growth perspective of balanced score card is being implemented.

Where the organization management fails to understand is that human capital is the key to every aspect of Balanced Score card. Its not about customer or financial perspective but it's about the internal process perspective which is ultimately depends upon learning and growth perspective. While adopting activity based costing we allocated cost with the various respective cost drivers. But did we ever take into account learning and growth perspective while designing the budget structure of an organization.

While preparing budgets we never allocate for learning and growth perspective. We design budget standards based upon the previous year actual numbers added with new notes being provide by the auditors of the company about the diversions and gaps achieved during the last financial year. I find while designing budgets balanced score card needs to be adopted so that all the segments of the organization and its respective cost centers are being taken into account.

Now a question might come up that how learning and growth curve can be developed and implemented within an organization. Say that one is working in a banking sector. Now if employees of an bank are being promoted based upon regular examination and qualification based and not on the basis of one time qualification then imagine the improvement of the bank and also of the entire banking industry. New type of products, streamlined process and efficient use of resources can be achieved. At the same time Indian banking industry will find stupendous growth in term of financial perspective which is prime aim of score keepers of the financial statements.

Well financial accounting models treats leaning and growth curve to be wastage of resources and simply cuts backs the budget allocation for the said purpose.

In India I find human capital is being rated at the lowest number. In financial industry in India I find human capital supply is being accounted as a free supply which leads to no requirement of any learning and growth curve. Insurance industry, mutual fund industry and financial distribution company I find high level of employee turnover ratio. The most common word being said while turning down one employee is that he is a non performer. I find organization is the biggest non performer since it fails to retain its employees. My brothers in the industry are the best speakers for these stories which have passed or that were still dwelling into such organization where human capital is rated at the lowest.

If politicians of a country are undereducated then how they can understand benefits of the various new technologies and how India can achieve its 8%+ GDP growth. Financial accounting model never identifies the same hence and organization never includes learning and growth perspective within its organization. Organization needs to develop open space where improvement of the employees aligning with the mission and vision of the organization is being cultivated. Organization needs to think that how they can develop their human capital which benefits the companies in the long term leading to an sustainable venture.

Well educated well developed learning and growth perspective helps an industry to grow over the long term. Balance score card is a compass which helps the organization to find the way of its direction while running business.

.gif)