The biggest question which will be chasing every investor is which asset class to invest in and where the investments will be safe. What type of rebalancing needs to be adopted? Before that, we all need to know how the different asset classes will be influenced.

Well, Berkshire was a net seller of stocks in both the first and second quarters of 2023 and also scaled back its share repurchases in Q2 – which hints that the legendary investor is not too comfortable with valuations of publicly traded companies or his own Berkshire Hathaway stock at current levels.

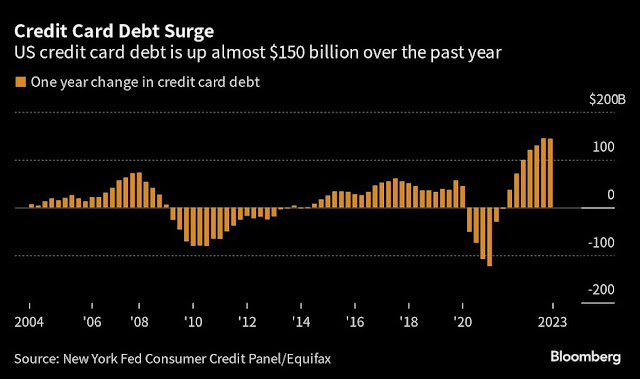

The current pile of Debt of the U.S. and China is a matter of threat to the global market. Indian markets might be discounting the threat for the time being but it cannot evade the liquidity risk. One of the biggest questions which comes to mind when we look into the U.S. treasuries and the pile of debt and interest rate flow, is the only question that comes to mind when investors stop treating US Treasuries as "risk-free"?

The S&P GSCI Industrial Metals Index, which tracks the industrial metals sector through futures contracts, is down nearly 18 percent from this year’s peak. The IFO shortage indicator, a survey of German manufacturers by the IFO economic institute, fell to 31.9 in June 2023 from 80.2 in March last year, marking a “significant” reduction. The price cut down in raw material cost is being witnessed in many companies where the benefits are being passed to the buyers. For example, LG Electronics Inc. has slashed raw material and transportation costs by 2.12 trillion won ($1.6 billion) in the first half. Another company Jinko Solar Co., one of the world’s largest panel producers, reported first-half profit surged 325% as lower raw materials costs helped the sector cut prices and spurred demand. Hence industrial inflation has already come down significantly.

Crude prices will remain elevated backed by production cuts down. The production cutdown comes when the demand is low and hence there will not be much benefit from falling demand.

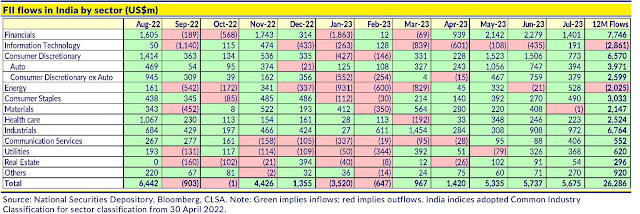

For emerging markets like India, it’s time for rebalancing and being cautious with markets. Widespread changes for investors during the quarter were a focus on resetting or upgrading the core of the portfolio in a shift “back to basics. Across the board, it being found that investor clients in ‘Portfolio Solutions’ focus on resilience, risk, and re-evaluating the core of the portfolio – getting the basics right. The rising debt pile across many economies leads to investors flocking for high-grade corporate bonds followed by sovereign bonds. Investors in fixed income should continue to see a strong focus on investment-grade credit versus higher-yielding segments. Without rebalancing and reinvesting wealth cannot be made hence it's time to get back to basics.

More focus will shift towards quarterly earnings and cherry-picking of quality long-term stocks in India where the opportunities of growth are mapped with GDP and industrial growth of India. PLI stocks will be in big focus followed by BFSI which cannot be ignored.

ETFs will be one of the hot flavors for the market and investors across the globe. Any correction in global equities will lead to a significant inflow into ETFs. ETFs have grown enormously in popularity over the past two decades. The total amount invested in ETFs has grown from around $200bn globally in 2003 to more than $9.5trn in 2022 translating into a growth of 20% and its projected to reach $15 trillion in the next 5 years. Retail participation will grow more in ETFs which will change the climate for investment advisory. In volatile times investors will divide between ETFs and active fund management and most will prefer to Passive where economic and market volatility is high.

New investors' acquisitions towards the market it growing consistently covid times. Recently in the month of July 2023, it was found that a total of three million new demat accounts were opened which is the highest in 18 months. As the Indian market maturity increases we will find more investors joining the market. In the last two years, Indian equity investors have grown from 2.8% to 4.8% which is below 5% currently compared to the developed economies. Whereas 13 percent in China, 33 percent in (the) UK, and 55 percent in the USA. India has therefore still got a long way to go before more of the population participates in the stock market directly.

Well as per CDSL and NSDL, the 3 million demat account opening in July is the highest since January 2022 and about 50 percent more than the previous 12-month average of 2 million. India emerges as a beacon of stability and growth, its stock market is poised to surge at an anticipated rate of 15 percent annually.

Hence investors will be looking ahead for equities for every fall in the market and will get into investment opportunities through SIP in direct equities and MF. ETFs will find the most flavored products for 1st timers. Debt will lose its glory once the interest rates start coming down and all Fixed Deposit inflows will come back to equities.