Many people across the world have been shocked to find that Mr. Biden economic policies have been a miracle where despite increasing interest rates inflation is not yet under control (as per the Fed Benchmark) but the job creation numbers are on the higher side. Let’s look at the numbers where inflation has come down to 3% in the US in June, down sharply after peaking at more than 9% last year as global commodity prices came down significantly across the globe and the same inflation also came down across all countries. Well the truth is hidden and it is snowball getting preapred for late 2023 and early of 2024.

Whereas the interest rates need no numbers to be explained how expensive it has become in living cost. Most of the US jobs are created in the contraction industry ( excluding real estate) as federal investments in infrastructure (Infrastructure Investment and Jobs Act), semiconductor chip plants (CHIPS and Science Act), and green energy construction.

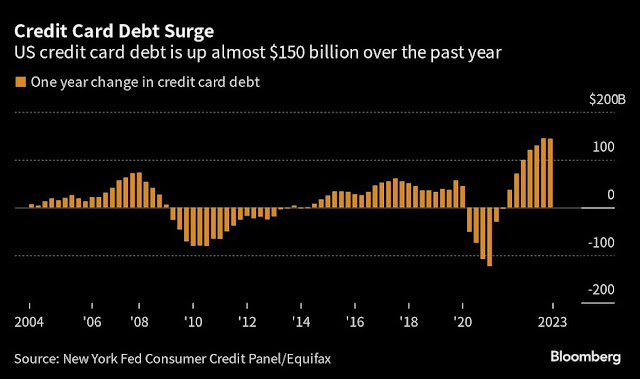

Based on recent data shows that the combined U.S. credit card balances have passed over $1 trillion, which is for the first time in the US economy. The buy now pay later (BNPL) has taken a significant quantum jump within the economy. Further, it has been found that Credit card balances during the 2023 second quarter rose by $45 billion to a series high of $1.03 trillion, according to a report this week from the New York Federal Reserve Bank. Retail credit cards and other consumer loans climbed by $15 billion during the quarter. The average credit card currently charges a near-record 20.53% interest rate. This category of debt also has the highest 90+ day delinquency rate at 5.08%. Well, credit card delinquencies are at an 11-year high, as measured using a four-quarter average, the data showed.

Getting deeper it's being found that the Millennials are having around total balances hit more than $4.2 trillion in the fourth quarter of 2022, a 27-percent jump from late 2019. Adding more to this it has been found in a survey that 57 percent of American consumers say they are living paycheck to paycheck. More than 72 percent of people making less than $50,000 a year live paycheck to paycheck, while 60.9 percent of people making between $50,000 and $100,000 annually live that way.

This speaks very loudly that with current high levels of interest rates in the US the cost of paying interest on the same will be manifold high as compared to any historical number and any default on the same will suck out liquidity from the US banking industry. This time it seems that the retail banking crisis is well prepared to be reserved on the table. Well, this credit card debt is not enough to make the global economy cry for liquidity but we have a few other segments to add full momentum to get a complete dry down. Total household debt increased by $16 billion in the quarter, totaling around $17 trillion. The cost of serving debt items is many like auto loans, student loans, mortgage loans, and business loans which finally leads to a retail debt trap. Further Federal student loan borrowers have not been required to repay their debt since 2020. The payment pause will resume in October, and the resumption of student loan payments will be a huge test for many cardholders and the economy as a whole. The impact on the living cost and consumption will be huge.

More importantly, we need to know that U.S. overall household debt has spiked by $2.9 trillion since the end of 2019.The high-interest cost serving is going to be a major reason for getting the whole retail market getting under collapse.

The long-term impact of this high debt and high-interest rate will be:

- Banks will have to write off these loans and take a hit on books

- Retail consumption from the US will slow down impacting GDP and stocks.

- Consumption numbers will come down

- The bubble of job creation will get halt

- Unemployment numbers in the U.S and other countries will increase as the liquidity crisis will spill over.

- Federal Funds are to be deployed for the revival of the banks

- US federal income will take a hit resulting less investments within the economy

- Borrowings will go up for the US government impacting more interest rate demand by the lenders.

- Banking M&A will begin in the US and in other countries where interlinked trades and businesses are holding these assets

- Emerging markets assets will find sell-off

- Markets across the globe will correct and might take some time to revive back based on different economic parameters.

This is the place where interest rate cuts down will be faster to save the US economy and the global economy from the liquidity crisis. The US bond market will face more tough times in the coming months as the spike in yields and the decline in bond prices will impact the banks. We all know that Lenders are traditionally big buyers of government bonds, so when the value of those investments declines, it can spell trouble. Well, find more liquidity crises emanating from the US and spreading to different parts of the world. We will find more rating cut-down in different banks in the US which will slowly place pressure on inter-related trades and papers held by other countries' banks.

The recent rating cut down by different Agencies might get again revised in the coming months as the median debt-to-GDP ratio of AAA-rated sovereign debt issuers is currently 39.3 percent; for AA-rated issuers, 44.7 percent. The current US debt-to-GDP ratio is 112.9 percent. This high level of retail debt and repayment is a matter of concern that might turn out to be a headache for the global markets and economy.

.jpg)

0 Comments:

Post a Comment