The world is facing the tremors of financial time bombs which are getting blasted from time to time. Europe has covered every country, states, town’s news papers and, TV channels and other media resources left on the globe with their ongoing crisis. Economists around the world are on the debate that does the world is coming to an end in 2012 through the economic disasters or will continue its fragile growth. I have no bets placed on this topic since I am not yet matured enough to comment on this topic. But all I can say is that till December 2012 we have to live and my job role is to write and depict to all of you the path till dead line of 2012.

We are almost come to the end of 2011 with one month left to celebrate Happy New Year. World has witnessed interest imbalances and the student of financial end economic subjects got live examples to understand how interest rates at Low end and Hind end affects every nation. We saw developed nations kept their interest rates to Zero with various strategies to grow inflation. Whereas Emerging economies witnessed the heat of Inflation rays and high interest rate cost. Interest rates and inflation has turned out to be the main problem of every economy. Western economies wanted to have inflation numbers to grow whereas as countries like India & china took measures to cut off inflation.

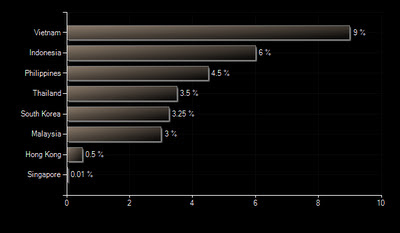

Interest Rates Asian Economies Excluding India & China Graph

In between all these the currency war also jumped up with yen getting depreciated against dollar. Indian also witnessed the same problem of depreciation against dollar. Fiscal measures of cooling inflation have spooked currency war. We have seen every economy in emerging nations has increased their interest rates at the beginning of 2011 to cool off inflation devil. Now when the slow down is affecting growth engines of the economy interest rates are coming down. Thailand’s Q3 GDP data show that the economy was struggling even before the flood situation worsened in late October. Thailand’s central bank will opt to cut its policy rate next week. Other central banks, including in Malaysia and Singapore, are also likely to loosen soon. It is expected that the Monetary Authority of Singapore (MAS) will loosen its policy settings in April. Philippines is also going to cut interest rates. While the big dragon China is also in the wings to cut down its interest rates since its economic growth has slowed. In the below image I have depicted only the South east Asian Economies since India and China are often read. We need to dig further to find the individual rates of inflation and interest rates which will reflect the whole economic condition of emerging economies.

Inflation Graph

Commodity prices remained on the higher side backed by global uncertainties of natural calamities. The recent flood situation in Thailand has erupted serious problems for the steel sector. The bulk commodity, the raw material for steel and one of the most important global natural resources markets IRON ORE, has leapt 27% in three weeks. Thailand is the largest supplier of the raw material and due to its flood the mines have been shut and in many cases the production has been slashed by beyond 50%. At the same time steel production and other linked products like automobile and others have also slashed their production.

Japanese steelmakers in particular have started shutting down some production. For example, Nippon Steel, Japan’s largest steelmaker, last week reduced its guidance for steel production to 15.25m tones for the October-March period, down 6 per cent from last year. This has also created markets for the greedy market players to hike prices internationally and take opportunity of the time. As metal remain one of the prime contributors to the emerging economies GDP growth, hence we wait for more down turn in inflation rates in the emerging economies and also interest rates are going to climb down. The bugle of interest rates to climb down has already blown. In 2012 we will find growth from low interest rates as GDP decline has started affected growth emerging economies. We need to find what developed nations do regarding inflation.

0 Comments:

Post a Comment