We have experienced many

instances of very qualified people totally mess with Big Financial Institutions. At this point in my life, we do not need a

Havard Graduate to teach us finance. Silicon Valley Bank collapse may lead to

1,00,000 layoffs, impacting 10,000 startups as per statements from Y Combinator

to US Treasury Secretary. The most important thing to find out is what was the

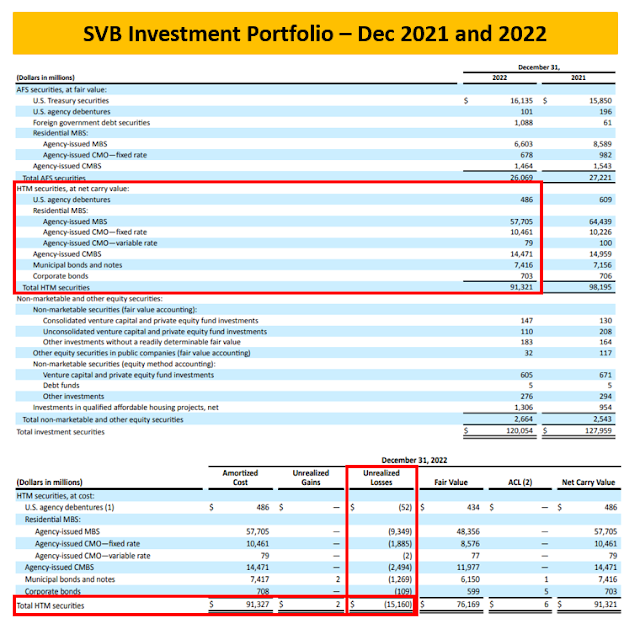

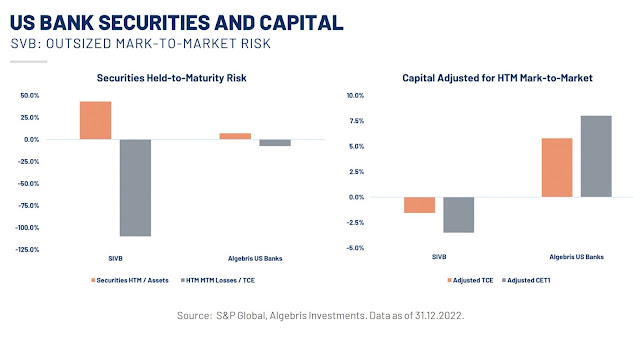

problem with SVB? SVB had a gigantic investment portfolio as a % of total

assets at 57% (average US bank: 24%) and 78% was in Mortgage-Backed Securities

(Citi or JPM: around 30%). SVB was among the top 20 American commercial banks,

with $209 billion in total assets at the end of last year, according to the

FDIC.

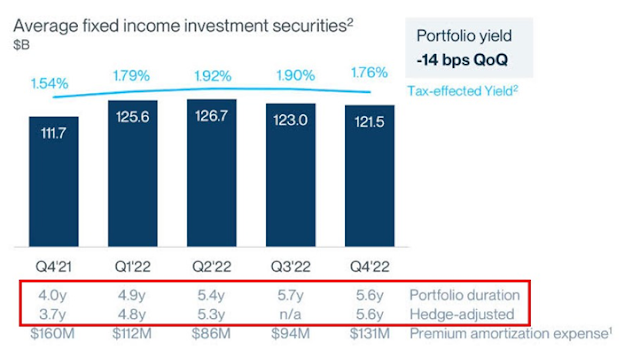

They did not hedge interest rate risk at all! The duration

of their huge portfolio before and after interest rate hedges was the same?!

Effectively, there were NO hedges. This means SVB was not applying basic risk

management practices and exposing its investors to interest rate risk. Well,

don’t be shocked. The bank a $120 bn bond portfolio with a 5.6y duration means

that every 10 bps move higher in 5-year rate lost the bank almost $700 million.

Basically, the entire bank’s capital was wiped out. Prominent block chain venture capitalists have over $6 billion worth of

assets held by the now-defunct financial entity.

In December 2021, SVB had about $10 billion of interest rate swaps. The most shocking part is that Crypto investment firm Morgan Creek Capital was found to be a large depositor at Silicon Valley Bank. Bitcoin maxi Anthony Pompliano is a partial owner of the firm and has been urging the government to bail the bank out. This means the preparation of bailing out and collapse was triggered long back. Now, the question comes to mind does this mean that the current interest rate of the US is becoming unsustainable for the US banks?

The Fed moved aggressively, and higher borrowing costs sapped the momentum of tech stocks that had benefited SVB. Valuations came down and equity earnings were falling out.

Higher interest rates also eroded the value of long-term bonds that SVB and other banks gobbled up during the era of ultra-low, near-zero interest rates. This was a massive blow when it is found that the SVB’s $21 billion bond portfolio was yielding an average of 1.79% — the current 10-year Treasury yield is about 3.9%.

The impact on the capital market will be that banks' stocks will fall and financial contagion calls will trigger resulting in more correction for the stocks. Further startups will get stuck in the vicious cycle of funding crisis spilling over to other segments. Layoff numbers will come up higher.

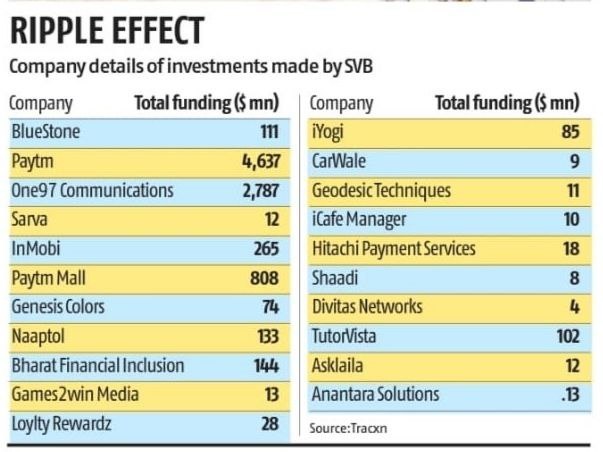

SVB has invested in around 21 Indian startups,

as per Tracxn data, but the exact investment amount is

unclear. Other startups that raised funds from SVB include Bluestone, Carwale,

InMobi, and Loyalty Rewardz. Tracxn data also shows that SVB has not made

significant investments in Indian startups after 2011. The Tracxn list includes

Paytm, Paytm Mall, and One97 Communications.

0 Comments:

Post a Comment