The world is fearing and waiting aggressively for the rate hike from Us Federal. The world is more worried about the reversal of capital inflows from the various markets and asset classes where the inflow has been growing over the last 6 years. My point of research is that I find US economy to struggle for the next 15 years to 20 years. Yes the reason behind is the catastrophic debt burden which have widened the income –inequality and growing mental pressure on the behavioural culture of consumption and investments. This have been grey area which have been ignored by many as we are all focusing towards magic’s to happen in the US economy. We will figure out all the parameters behind the 15 to 20 years time frame for the US economy to grow and also the affect on US citizen due to interest rates hike. In my research I have further found that profitability have grown at the social cost and also the interest affect on the low wage income growth segment.I find that interest rate hike is going to create more income-inequality for the US economy.It also shows that US war has only benefited the cash rich and the middle class still struggles and will continue as it has generation factor effect.

US people have witnessed strong slowdown where jobs were cut down and unemployment grew up. They are unable to pay the bills and also unable to save money as existing debt is taking time to fully repay. Low wage growth and stiff competition in the job market has lead prolonged time for payment of debts.

Education loan has become a burden and further unemployment amplifies the process of income-inequality and low consumptions. High un-employment has resulted young generation to stay with their parents and hence more dependency on social benefits and pension earners.

US have taught its citizens to borrow and spend over the last decade. This is the particular phase when the US was busy in focusing its people towards the war in Afghanistan and other countries. We say and we now that defense spending have been one of the key growth driver of any economy but what about these people who are suffering due to unemployment. Now lest get into number and facts crunching phase over a cup of coffee.

Manufacturing segment contributes 12-13% to the GDP of US according to US manufacturing government data and also according to the World Bank report. The rest belongs to service sector. The most surprising part is that from 1967 the percentage of manufacturing to GDP has been on a decline trend which clearly indicates that spending on defense added less to the GDP. Massive imports have been the reason behind the decline of US manufacturing jobs. Now lest get into the % of employment it generated from the manufacturing segment. The manufacturing sector employed 12 million workers in 2013, or about 8.8 percent of total U.S. employment. So 91-92% of the rest employment is based on service sector.

US Manufacturing

The service sector comprises of people belonging from the segment where skilled labour percentage in terms of having higher education degree is less. Hence job related skill is the key education which creates job for these 86% of the segment.

Now the wage growth level of skilled and high skilled labors are bound to go up but the pressure of low wage growth is being felt on the lower bottom level of people belonging to the service sector. Nearly 40 percent of American workers earn less than the $15.00 an hour demanded by the low-wage workers movement. It may be a surprise to you that the job with the most workers is that of retail salesperson. Over 4.4 million Americans are employed in this job category. This job pays very little but also carries almost no benefits. Then we wonder why many of the 46 million Americans on food stamps actually have jobs. But let us look at the top fields more carefully:

The top 4 employment sectors are:

- Retail salesperson with 4,485,180 employed

- Cashiers with 3,343,470 employed

- Food prep and service workers with 3,022,880

- Office clerks with 2,832,010

Low wage jobs and poor growth of these job wages have been the biggest draw back for the US. These are the main US consumers which moves the consumption index of the economy are the one who are struggling. The next top field is nursing which does pay a good wage but requires people to go to college. This requires investments and also quality education categorized under skilled labor force. Following nursing, the next top employment sector is waiters and waitresses. The above job segments are very dicey in terms of lack of job security and the resultant rate of high turnover, few or no benefits, a lack of paid sick days, and quite often irregular or part-time scheduling. Now if these reason rules the industries then just simply make out what type of growth you can expect and what would be the affect of the US interest rates to climb. Now just imagine if the interest rates hikes do you think these companies who are employing these segments would be able to maintain the same EBIDTA and Profitability margins. Profits are rising at the social cost and not on real macro factors.

Education loan -the Economist reported in June 2014 that U.S. student loan debt exceeded $1.2 trillion, with over 7 million debtors in default. Public universities increased their fees by a total of 27% over the five years ending in 2012. According to New York Fed data he biggest growth in the program came in the past decade, as student debt rose an average of 14 percent a year, to $966 billion in 2012 (Currently $1.1 trillion) from $364 billion in 2004. The burden of education loan is creating a huge impact on the behavioural culture of the US citizens, as they are no longer interested in borrows and spend formulae. This is the key reason that despite of zero interest rates consumption is not picking up. Low wage is an reason but more than that its being found the they are prune towards savings rather focusing on spending. Later at the end I will prove the number based rationales behind the significant growth of educational loans. The macro reason is that to bridge the gap of income-inequality with rich and poor another bigger in-equality of today have been created. Its the steps which have been adopted by the mass US citizens to copy the life style of the rich.

Why it will take 15 to 20 years?

The valuation of the current net worth of the US citizen who comprises within the bracket of 86% from the service sector-out of this around 80% is struggling to pay of its debt burden either in the form of credit card, house or education loan. Low wage growth and less social benefits and half time jobs are creating havoc on the minds of the US citizens who are always counting every coin they are spending. When one two simultaneous generation suffers the pain slowdown in consumption pattern and change in behavior are bound to come. Young generation takes double lesson from both angles of the society.

Coming to the income-inequality its being found that when the net worth of a family wipes out and it takes considerable time to revive the same then growth of the economy is going to be slow. Zero or low net worth leads to diversity among the people which creates more problems for one part of the society. In fact we have come to the period where the rich cannot r bring growth for the economy and the US political system will understand that only framing policies and benefits for the rich segment of the US will not be game to be played in the near term. Zero interest rates benefits have gone to the corporate shareholders and 20% of the cash rich segment of the society. It has hardly benefited the struggling middle class which has been dragged to below that level.

US citizens are increasing their savings so as to improve their net-worth. The average household’s savings rate jumped to 5.5 percent in 2014, up from 4.6% percent in 2013. They are saving more since they are scared due to lack of job security and the resultant rate of high turnover, few or no benefits, a lack of paid sick days, and quite often irregular or part-time scheduling. These factors which are changing the behavioral pattern of the US citizens over the long term. Americans saved about 4 percent of after-tax personal income in 2012, down from average saving rates of 5.5 percent in the 1990s, 8.6 percent in the 1980s, and 9.6 percent in the 1970s. The drop of savings rates further burden of debt is the key reason behind prolonged recovery from US. If we look into other countries we all know that US economy and its citizens are in the worst shape.

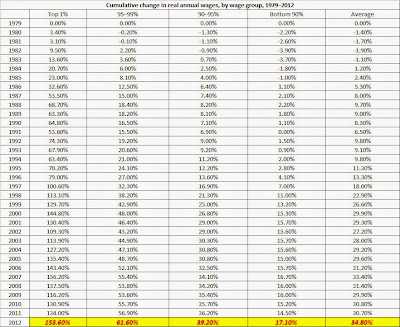

Income in-equality followed with gap in wages did not happen overnight. We all know that when productivity grows for an economy then its wages also grows. But in my research I have found that this growing income-inequality did not happen form 2008 recession. The whole preparation was happening over several years. Between 1979 and 2013, productivity grew 64.9 percent, while hourly compensation of production and nonsupervisory workers, who comprise over 80 percent of the private-sector workforce, grew just 8.0 percent. Productivity thus grew eight times faster than typical worker compensation. Picture become clearer when we find that the rich only became more rich as their compensation grew like anything.

Now the point is that due to low or negative net worth, growing income-in-equality and low wage growth quality of education and skilled manpower supply will be very low and will be negatively impacted which creates more slow down in the long term. Those who are in the age of 12-15 will be struggling due to this income in-equality. Lets go for deep drive and we find that compensation policies were focussed towards higher income class segment which also proves the theory of why education loan grew as it symbolized that getting education at par with rich would be the path to reduce income in-eqaulity.

The Dowjones might climb 30000 over the next decade but that the grass roots of the economy will be struggling with a change in behavioural pattern over the long term. The growing income inequality is only going to widen if ground level policies are not being framed. Now just imagine if the interest rates hikes do you think these companies who are employing these segments would be able to maintain the same EBIDTA and Profitability margins. I find US will have deep affects of its interest rate hike for the US citizens who are the middle bracket or just below the rich.Rising income inequity would lead to low consumption and more inclination towards savings. The days of borrow and spend are over and the world economy should not expect a quick sustainable recovery for the US economy. The burden of debt and the fear of the same have now rolled over to many generations mindsets and one should consider these factors while coming out with any positive projections. US economy will take more than decade to get a free debt household. Savings would increase and income inequality would lead to significant growth of economic threats for the society. I fear that these dark clouds would spoil the young generation between the age bracket of 12-16 as they will hardly find the space to compete with rich skilled manpower. Migration of employees to US economy would be threat in the coming days as pains and tears would break the patience of the struggler. I doubt that US is no more interest for any war as its shows clearly that War has benefited the rich more compared to the middle class who have been neglected over the years as it shows that productivity increased where as hourly wage decreased.

0 Comments:

Post a Comment