Good times of the Financial Markets teach us hardly any lesson but when it comes to the worst times many lesson are learnt and they are forgotten too. In my research I have found out that Indian economy needs to plan its economic policies and construct its demographic pillars is such a fashion that when the next bubble of financial crisis will hit India remains as sweet pot of investments. In my recent study I have found that when the Asian financial crisis struck and also the 2008 recession, in both events the most common thing was to learn is how the economies are well prepared in getting back into shape. We don’t know precisely when the next recession or the financial crisis will erupt like a dormant volcano but certain things could be sensed from the every time before the eruption happens. The Indian economy needs to strengthen its macro economic factors so that after the crisis the inflow of funds happens quickly. I will be discussing few areas of such strengthen ways on which India needs to think over and react accordingly.In my research I have found that if a country have a High Savings rate to GDP ,it becomes quite easy for the economy to revive after financial crisis. After crisis every developed economy looks for those economies where ROI is secured and can be generatedhealthy compared the crisis economies.

Where the Inflow Happens?

The current economic status of India is good but far from off from best. Sentiments have revived and actions have started happening from the government end and also from the corporate segment in terms of rescheduling manufacturing and capex planning. Also the CAD has started coming down which gives immense favorable position to India to attract investments from overseas. My area of research is focused towards preparing India for those times when another round of financial bubbles would come out over the next 5 years. If we go through the history of financial crises we find that whenever a crisis struck 3 segments of the economy starts finding redemption portfolio investment (equity and debt securities) and other investment (i.e. bank loans) are distinct from foreign direct investment (FDI).

The historic Inflows:

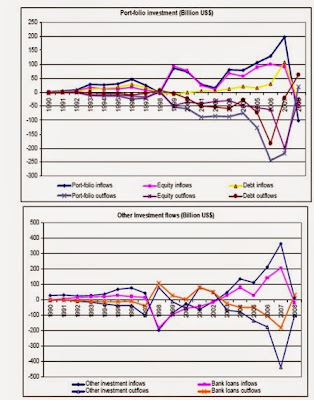

The Asian financial crisis interrupted capital inflows into developing Asian countries and net capital outflows registered during 1998-2000 (Figure 1). The responses of capital inflows to the crises, however, are different across components. FDI flows had proven to be more resilient in the wake of Asian financial crisis than other forms of capital inflows, i.e., portfolio (both equity and debt securities) and bank loans. While portfolio inflows and bank loans declined substantially and the latter registered a negative level during 1998-2002, FDI inflows continued to increase during this period (Figure 2).

Figure 1

Figures 2

Now it’s well clear that whenever FII money comes into the system, when a global crisis strikes in the whole investments flows back and gets the economic products under high risk like bonds and debt markets. Investors lose billions and there is prolonged crisis of fear among the investors. This has been the common trend of every financial asset class’s bubbles getting burst. This is the birth place of economic strength which compels strategy formulation during the good times of the economy. This strategy save the economy from these crisis situations and helps the economy for a quick revive. In the last Asian Financial crisis it has been found that despite of slowdown it has been found that FDI investments have grown. Debt Market attracted inflow of capital and also they created good growth opportunity for the growth. FDI investments grow due to low cost of production in the emerging economies followed with increase in mergers and acquisitions (M&A) activities instead of Greenfield investment. This is one of the key are which I will discuss broadly later on.One needs to be cautious about such movements of acquisitions. There are plethoras of companies who are still facing the burden of those acquisitions on their books of accounts.

Where we need to prepare?

We need to prepare the Indian economy for all those uncertain times and this should be part of the policy frame work which needs to be executed in the good times. Rising per capita income is one of the tool which reflects the strength of the economy in good times which acts a shield during the time of financial crisis. Since during financial crisis liquidity dries up but if an economy has sufficient per capita income then obviously consumption will not be so bad compared to a low per capita income economy. Further FII’s investments always follow in that country where growth can be achieved compared to the most affected country.

Savings rate of GDP is the Key for Recovery of an economy and inflow of FII's money

Moreover if you savings ratio to GDP is higher leads consumption option open during crisis times. Developed economies look for those countries where per-capita income to GDP I higher and based on this credit rating companies gives positive ratings to the country based on which fresh investments are being executed by the developed countries after the financial crisis. Hence its clear that our policies should be friendly enough to promote consumption during recession and also the per capita savings ratio compared to GDP will lead to a favorable market condition for investments.If we make a quick look at the below chart we find that countries who are having higher percentage of Savings rates are better placed after the recession of 2008.

Now a healthy per capita income drives consumption which keeps the sale of the companies going on compared to other economies where sales just simply goes blank. This is why we need a high per capita income. Another segment which helps FII’s to get back is the FDI route. If your policies are friendly enough then you can easily attract FDI investments. This has been found historically at the time of Asian financial crisis. Capital outflows, both in terms of FDI and other forms of capital, have become increasingly important for the region. Gross capital outflows reached US$770 billion in 2007 (10.5% of GDP), from US$47 billion in 2002 (1.3% of GDP). The amount of outward FDI also rose substantially to US$155 billion in 2007 (2.1% of GDP), up from US$33 billion in 2002 (0.9% of GDP). The geography of outward FDI in the region was still concentrated in developing countries, i.e., in 2004 around 80% of total outward FDI went to developing countries, increasing from 69% in 1993.

WHY FDI Increased?

FDI increases since doing business through green field process creates synergies and easy penetration into markets and efficient diversification of resources which generates healthy ROI compared to other economies that are messed up with financial bubbles aftershocks. We Indian also do the same application of the theory that during the boom times we enter into developed economies for M&A. Indian companies expand their business through Greenfield operation and acquires projects at high cost which becomes burden during down turn phase of the Indian economy.

Internal factors are crucial in affecting movements of portfolio investment and bank loans, namely growth prospects, friendly policy, returns and risks, as well as investment saving situation in a host country. These factors are the key for the revival of an economy after the financial crisis. India needs to make most of the best achievements in strengthening its internal policies.

1 Comments:

Suitable times of the economic markets teach us hardly any lesson but with regards to the worst times many lesson are learnt and they are forgotten too. In my studies i have observed out that indian economy needs to plot its monetary guidelines and assemble its demographic pillars is the sort of style that once the subsequent bubble of financial crisis will hit india remains as sweet pot of investments.

Know More

Post a Comment