The Indian India’s

Purchase Manufacturing Index (PMI) for manufacturing is recorded at 58.3 in

June. If we want to have the PMI to be around 60 + and for a

prolonged period we must understand that the same is dependent on macroeconomic

investments and reduction in cost of operating. India needs strategic cost

management and investment in Indian transportation segment. India needs a

mix of transportation for bringing down the cost of transportation from the

current 14% of the GDP through judicious mix of road, coastal roads, railways.

But one this is

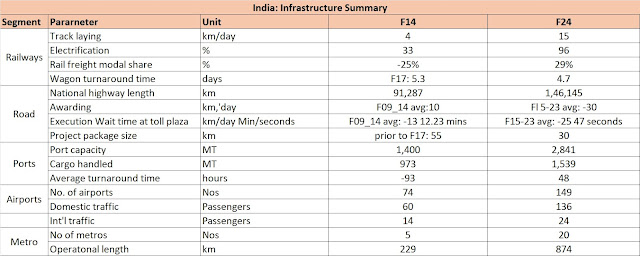

noticeable enough to highlight which cannot be ignored that in last 10 years

Indian infrastructure project speed as picked up significantly.

Indian

economy needs significant infrastructure growth to bring down this cost to

within the range of 4 to 5% by 2030. It is envisaged India’s infrastructure

investment to steadily increase from 5.3% of GDP in F24 to 6.5% of GDP by F29.

Indian GDP cost to transportation will reduce the logistical costs

(14% of GDP) of the Indian economy, thus improving India's competitiveness will

be helping to achieve our forecast of a rise in share of

manufacturing in GDP from 14.2% in F24 to peak at 21% by F31 and remain steady

thereafter, implying a manufacturing base size of US$1,657bn by F34. Indeed,

this implies that infrastructure investments are expected to register a strong

15.3% CAGR, resulting in cumulative spending of US$1.45tn over the next five

years. Further once we find some tariff war type of situation Indian

economy will need to focus on domestic consumption of industrial goods and

production replacing the export market growth prospect even for a short span of

time.

Investing in

infrastructure and Production-Linked Incentives (PLI) presents a robust

strategy to safeguard India's GDP against potential geo-political disruptions

over the next five years. Strategic cost management will make the segment of

various PLI of different industry attractive only when the ancillary industries

growth is married to the same. This proactive approach not only bolsters

economic resilience but also fortifies growth prospects amidst global

uncertainties.

The incremental capital output ratio (ICOR) is expected to improve, signifying greater efficiency and productivity across sectors. A more sustained economic growth path is envisioned, with positive social implications stemming from improved infrastructure.

But center

alone cannot bring this growth through central government spending plans. State

governments have critical role to play and same is getting reflected when we

dig into states. State government involvement have also grown in these sectors.

All states and Union Territories (UTs) are on board. State governments have

been forming their own state logistics policies along with the State Master

Plans, which are being aligned with the NLP. As of August 2023, 22 states have

notified of their state logistics policies. On the other hand warehousing

standards the NLP guidelines also focus on warehousing standardization through

six key areas and use of automation, artificial intelligence, and Industry 4.0.

Further the Unified Logistic Interface Platform is going to bring

growth in coming years.

Investments in infrastructure are expected to yield positive outcomes for the equity market. Infrastructural enhancements are likely to mitigate inflationary pressures, fostering conducive conditions for corporate profitability. Improved infrastructure supports enhanced competitiveness, potentially driving equity market performance upwards.

Government-led initiatives such as Bharatmala, the national rail plan, Sagarmala, Power for All, and waterways development programs are pivotal in scaling up India's infrastructure capabilities. These initiatives aim to facilitate faster and more cost-effective movement of goods, thereby stimulating economic growth and attracting foreign investments.

While

significant progress has been made over the past decade, India's journey

towards achieving a GDP of USD 5 trillion by 2030 necessitates continued

infrastructural advancements. The ongoing Pradhan Mantri Gati Shakti (PMGS)

initiative exemplifies efforts to reduce logistical costs and enhance

manufacturing competitiveness. By optimizing logistical efficiencies and

leveraging infrastructural enhancements, PMGS aims to elevate India's

manufacturing share in GDP to 21% by F31, reinforcing its economic foundation.

Expectations include a doubling of export volumes, driven by heightened competitiveness facilitated by infrastructural upgrades. Initiatives under PMGS, focusing on rail and coastal freight movements, are poised to lower logistical costs and enhance export competitiveness.

One of the most remarkable thing to notice is that India's rank improved across infrastructure: 47th (2018: 52nd), international shipments: 22nd (2018: 44th), logistics competence: 38th (2018: 42nd), timeliness: 35th (2018: 52nd). It deteriorated in certain aspects like customs: 47th (2018: 40th) and tracking & tracing: 41st (2018: 38th). But there is much headroom for improvement in these rankings. This have been achieved and will be achievable through judicious mix of strategic cost management and investments.

The emphasis on rail infrastructure development is anticipated to bolster demand for core commodities like steel, cement, and aluminum. Adequate capacity building across these sectors is crucial to prevent potential inflationary pressures and project delays.

Infrastructure spending, as highlighted by the Reserve Bank of India and the National Institute of Public Finance and Policy, is expected to have a multiplier effect on GDP, ranging from 2.5 to 3.5 times. This underscores the pivotal role of infrastructural investments in driving broader economic growth. An upswing in investments is set to fuel corporate profitability, underpinning a new profit cycle within the Indian economy. This trend is indicative of robust structural reforms and macroeconomic stability, fostering a favorable environment for sustained growth in corporate earnings.

Conclusion:

Collaborative

efforts between the central and state governments, along with proactive

sector-specific policies, are instrumental in enhancing India's logistics and

infrastructural capabilities. The National Logistics Policy (NLP), coupled with

state logistics policies, underscores concerted efforts to standardize

warehousing practices and optimize logistical operations. India's

infrastructural rankings have shown improvements across several metrics,

reflecting ongoing efforts to enhance infrastructure quality and efficiency.

Continued reforms are essential to further elevate India's logistical prowess

and global competitiveness.

Strategic cost management and investments in infrastructure and PLI initiatives are pivotal in fortifying India's economic resilience against geo-political uncertainties. These efforts not only foster sustainable economic growth but also position India as a formidable player in the global economic landscape.

0 Comments:

Post a Comment