Why the Sanctions on IRAN is so important and why the US wants to have a monopoly in crude supply and kill the shareholding of the OPEC is a trillion dollar question? At the same time being an economist I find that till 2020 and may be beyond the same crude will remain low despite any war etc. I have also tried to figure out that Mr Donald will win the 2nd term also in 2020.

Now let’s get back to the 1stpart of the thesis so as to prove the final one. OPEC will have negligible scope to control or inflate the prices. Crude prices will remain low despite any political unrest or oil supply problems. Well, it has less to do with Donald Trump and more with the political owners who own the crude market. Climate change is bound to get hammered when political involvement is on the Oil companies’ stock prices escalation.

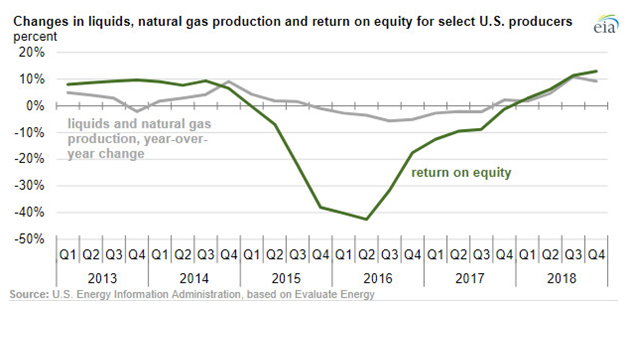

Mr. Trump has also millions of dollars directly invested in the fossil fuel industry. The FOSSIL FUEL based company’s stock price escalation in the last couple of years reveals how much net worth has grown for the political members associated with the same. Net income for the 43 U.S. oil producers summed up to a total $28 billion in 2018, which is a five-year high. Based on net income, 2018 became one of the most profitable years since 2013.

The return on equity by the companies in the US has been quite phenomenal.

The crude money plays a pivotal role in the upcoming US election in 2020. Below is the list of the contribution made by the US oil Giants in the Presidential election where both the segments Democrats and Republican both have held over the contribution made by this industry.

Well, the same contribution with renewed new figures will come up soon in 2020. This is the prime reason why the US will play a monopolistic game towards controlling the price of crude and not letting OPEC have its share increase. The various countries which were crude suppliers are now in deep trouble giving immense space to the US to play its cards.

A a quick look at the contribution made by the OIL Giants towards US Politics:

· Amount the fossil fuel industry spent during the 113th Congress (2013 & 2014) on contributions to Congress’ campaigns: $42,373,561

These numbers speak and support why crude prices will be lower and why OPEC and other countries will keep losing their shares and US will keep gaining its muscles. US banking industry is longer in those Golden days as compared to Pre 2008 era. Hence the flow of capital is now coming from Oil Giants.

Now a big question in everyone’s mind is that will Donald get a 2ndterm. Well, he is bound to get it. He has been able to keep crude prices low and hence Americans have been pretty okay to pay bills. The industrialist lobby is happy with the scrapping of climate change and giving more subsidies to these oil companies. Yes subsidy the indirect tax payer’s money going to the pockets of the oil Giants.

The basis of the argument that Mr Donald will win the 2020 elections also is based on much the favourable decision was given in favour of the oil giants. He is going to be funded by them only.

- Withdrawal of the United States from the landmark Paris Agreement,

- Repealed President Barack Obama's carbon-cutting Clean Power Plan

- Rolled back mining restrictions

- Reduction in Outer Continental Shelf royalties

- Rollbacks of Obama era fracking and methane emissions rules.

- Ignored government climate reports

- Repeal of the Obama administration's ban on offshore oil and gas drilling in U.S. coastal waters.

The above few changes by Mr Trump gives a clear indication that he is going to be backed by the Oil Giants in 2020 to print money for the next term for these people. Well for crude importing countries its joyful time or rather era as crude prices remain much below the level of $100/barrel.

Well What was lost in the 2008 crisis by the BIG Giants of the American economy I find 10 times have been earned by them in the last decade.

.jpg)

0 Comments:

Post a Comment