The financial market took a huge turnaround after the debacle of 2008 where demand and supply inequality were the main players. Industrial revolution took a halt across the world and financial market reflected more fearful days. Global GDP took one of the hardest turnaround followed with diverse policies towards growth and survival of recession.

In this article I would like to depict more about why the companies are not actively behind new projects and why there is an active change in capital budgeting and financial management aspect. I hope this article will provide a new thought for the Cost Accountants and Investment bankers. My main target is to develop the insight of Cost Accountants beyond calculations and to be an active player in the Indian economy as well as in the global economic platform.

The old books of financial management and capital budgeting techniques has changed after 2008 recession phase across the globe. Investment opportunity has all taken a dramatic change due to the changing factors of capital budgeting and financial management. Business schools have also failed in majority of the case to find out the difference in project slowdown after 2008 debacle.

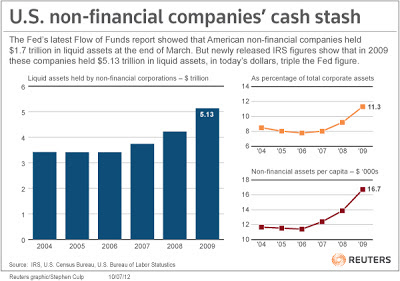

We have found that in India and in U.S economy corporate are having pile of profits in their books in the form of cash. Currently US corporate are having around $2.5 triilion as cash in their books of accounts. But they are still reluctant to drive into the ocean of investments since capital budgeting techniques will fail to capture the recessionary factors. In order to validate my data according to the recent report from Moody's Investors Service non-financial corporate cash position rose to $1.24 trillion at the end of 2011. The report further states, that nearly $700 billion, 57% of the corporate cash total, is held overseas which includes emerging economies. The below image depicts the same story.

One will be shocked to find that according to the Federal Reserve that, at the end of March, U.S. corporations held $1.7 trillion in cash reserves, which they keep in treasuries, other bonds, and bank accounts. When I drilled further I find that the cash position of the US corporate increased from 12% from 2006 to 24% from the Great Recession in 2008.

Time frame of generating cash flow is the biggest factor which the capital budgeting process will fail after the recession slow down. With negative growth in consumer demand in US and Europe and significant slowdown in Asian economy has changed the demand of any product. Hence more time will be consumed in generating a positive cash flow or even break even for any product as compared to the post recessionary phase.

Another aspect that fails to capture is the low cost of debt and equity component mixture within financial management of a project. US have got an zero interest rate which might seem like an gives an thumbs up to an investment project. But with significant slowdown in the global economy the real benefit of zero interest rate has negligible effect. At the same time with poor performance of the equity market and negative show down of the IPO market which is a key exit route for any venture capital and corporate finance has also changed the rules of financial management. Debt to equity ratio across the globe has taken a huge toll and a significant part of it can be witnessed in Indian market in the last 2 financial years.

Disparity about assumptions while drawing conclusion for project viability through capital budgeting and financial management techniques needs a high level of economic factors which needs to be accounted. I find project risk management has got a huge significant role to play since through this we can resolve the economic factors by certain percentage.

• Communication about risk in cash flow projection

• Identification of early risk in projects,

•Diverse markets and economic conditions linked with product consumption need to be linked with cash flow projections,

• In depth focus of equity option more than debt consideration should be the key aspect since equity is the key exit option for financial investments,

• Life cycle costing of the product should be mapped with different geographies since after recession of 2008 there has been an significant change in demand culture.

Well the above list might be incomplete and needs some more inclusion but it’s up to you to add up taking the practical aspects in mind.

In order to have new projects Cost Accountants needs to keep in mind those only mathematical calculations are no longer enough. One needs to grill into the cash flow projection factors while deriving the end result of the investment project. Geographical factors and product life cycle costing, needs to have a high level of priority to decide the project viability. Unless we cost accountants move ahead with these factors new projects will find times to come and hence the economic slowdown will only keep on growing.

0 Comments:

Post a Comment