The three sectors of the Indian economy witnessed slowdown in 2011-12. Moderation in agriculture growth notwithstanding, the year witnessed an all-time high food grains output. The services sector reflected the slowdown in construction, while industrial growth slackened due to the disappointing performance of mining and manufacturing sub-sectors. Data relating to Q3 of 2011-12 shows that growth moderated for the fourth successive quarter to 6.1%, recording the lowest rate in the last eleven quarters. The agricultural sector is facing the heat of non availability of storage facility. According to RBI its is marked that the current stock of food grains, at 53 million tonnes, continues to be much higher than the quarterly buffer and security reserve requirements.

PE & IB :IDENTIFY NEW AGRICULTURE AREAS.

India needs extensive investment to support agricultural research, development of water resources, infrastructure, particularly, power, storage and transportation.PE and IB needs to focus on these areas of investments where Agricultural growth can be achieved. New strategies need to be developed for doing investments into these areas. In Western economies its is found that factors which are driving interest in agriculture are surging commodity prices; increasing dfood demand of agri products thus prices will remain high for the medium-term and sustained or growing demand for biofuels.

In an recent projection like the one from the United Nations’ Food and Agriculture Organization found that 70% more food production will be needed to feed a projected global population of 9.1 billion people by 2050.Western economies are doing aggressive investments in agri products since they have identified that healthy commodity prices will continue to climb and are here to stay since Asia can’t feed itself. According to their investment target is focused on Asian nations which will need lot of commodity products and the suppliers will be from South America, but also from the United States and Canada. Hence western economies are making their PE and IB is just printing money from investments in agri sector. India has much potential to do investments.

PE can find investments in Crop insurance which is very much highly required in Indian demographic conditions.PE and IB will find prime opportunities in crop improvement and biotechnology, fertilizers, infrastructure, irrigation technologies and machinery. Yes among these entire investments one should not forget that a return from these investments is long term deal and good things takes time. Investments in agriculture typically have a longer time horizon than most private equity investments hence patience is the most important capital needs to be adopted by the PE.PE should invest in entrepreneurs who are coming into agriculture sector. Since they are equipped and well versed with modern technology and business centric strategies which will help Indian agriculture sector to achieve tall heights. Once the land acquisition bill get changed PE can do investments in farm land buying them up and later on leasing them to the farmers and reaping the long term gains.

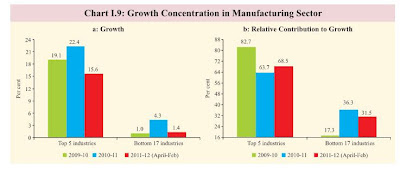

We have become too much dependent on service sector and manufacturing sector. Industrial growth slowed down sharply during 2011-12, led by contraction in mining and poor performance of the manufacturing sub-sector. Industrial activity lost steam on account of weak demand for consumer durables, reflecting interest rate sensitivity, deceleration in external demand and subdued investment demand due to decline in business confidence. If one makes an quick look towards the IIP numbers from April 2009 to February 2012 we find 3.3 for IIP excluding capital goods compared with 4.7 for the overall IIP during the period April 2009 to February 2012. Manufacturing sector growth remained volatile and highly concentrated, with seven out of the twenty two industry groups showing negative growth during April-February 2011-12.

Moreover in 2012 we will find slowdown in global economy backed by slowdown in Europe Indian manufacturing will find difficulty to dump its manufacturing. Export market will remain tight hence growth from manufacturing will be difficult in 2012-13. The eight core industries grew at a subdued pace of 4.4% during April- February 2011-12 compared to 5.8% during the corresponding period of the previous year. This is mainly on account of contraction in natural gas and poor performance of coal and fertilizer industries.

Moreover in 2012 we will find slowdown in global economy backed by slowdown in Europe Indian manufacturing will find difficulty to dump its manufacturing. Export market will remain tight hence growth from manufacturing will be difficult in 2012-13. The eight core industries grew at a subdued pace of 4.4% during April- February 2011-12 compared to 5.8% during the corresponding period of the previous year. This is mainly on account of contraction in natural gas and poor performance of coal and fertilizer industries.

In the recent finding by RBI it has been found that the Order Books, Inventory and Capacity Utilization Survey indicates that the y-o-y growth in new orders in Q3 of 2011-12 was lower than in Q3 of the previous two years. In simple terms new order formation for the manufacturing sector remained slump compared to the peak of 2010-11.Capacity utilization dropped resulting surplus productivity in cement and thermal power.

Service sector managed to maintain the growth but shows signs of plummeting due to decline in construction activity in India. Decline in new investments has resulted drop in construction activity. A revival in domestic industrial activity and improving prospects can improve the service sector growth prospects in 2012-13. The quarterly quick surveys of employment situation conducted by the Labour Bureau in select sectors of the economy indicate that employment generation slowed in Q3 of 2011-12 compared to Q2. Further salary growth remained in comfortable levels.

Led by engineering services sector, the projected jump of 12.9% in salaries for this year is higher than the actual increase of 11.7% seen in 2010.It is being expected that once investment cycles come into full swing service sector is expected to touch the peak levels of 2010-11.

Led by engineering services sector, the projected jump of 12.9% in salaries for this year is higher than the actual increase of 11.7% seen in 2010.It is being expected that once investment cycles come into full swing service sector is expected to touch the peak levels of 2010-11.

Hence keeping all the three sectors in mind it is being found that agriculture sector needs PE investments since other sectors are prune to global macro factors matched with domestic factors. But consumption of food products and commodity prices will continue its upward rally. Where western economies are printing money based on the Asian economies agricultural slowdown. If and when private equity investments in agriculture become more common, several impacts from the influx of capital could take shape. Substantial private equity investments would also likely result in an intensification of mechanization and escalation in the trend toward larger-scale, more vertically integrated operations developing the Indian agricultural sector.PE and IB needs to come up to grow the Indian agricultural growth.

.jpg)

0 Comments:

Post a Comment